The gaming industry is shifting in substantial ways. Not just incremental updates or minor spec bumps—we’re looking at changes that could reshape how games get made, distributed, and played. The global market is projected to hit around $522 billion by the end of 2025, with mobile gaming pulling more than half that revenue. The industry economics are reshaping in ways that weren’t predictable even two years ago.

Cloud Gaming Infrastructure Is Maturing

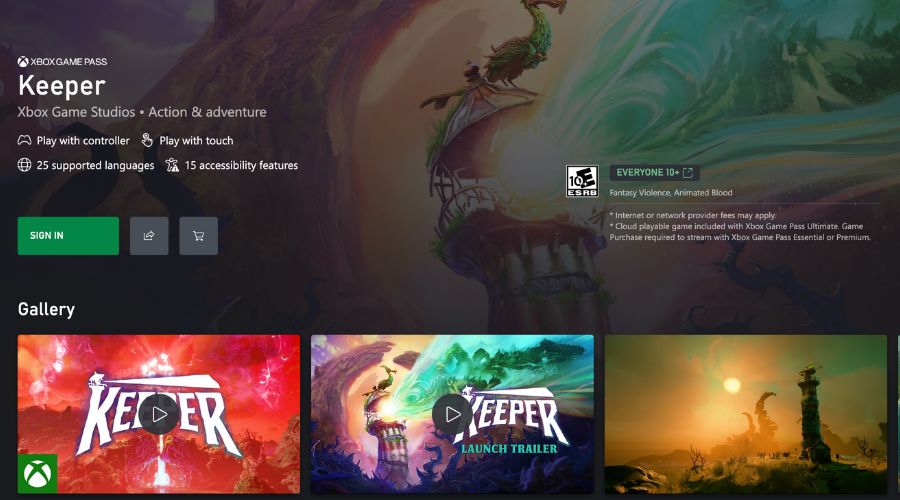

For years, cloud gaming felt like one of those technologies that was always “just around the corner.” But the infrastructure is catching up now. Services like NVIDIA GeForce Now, Xbox Cloud Gaming, and Amazon Luna are streaming graphically intensive titles to devices that couldn’t traditionally handle them. You can play AAA games on a phone or a budget laptop without the GPU to back it up locally.

市场预测表明,云游戏收入可能在2025年达到105亿美元,并可能在2029年翻倍。一些分析师预测,到2032年,这一数字可能高达1590亿美元,尽管长期预测应谨慎对待。

What’s making this possible? Edge computing is processing data closer to users, reducing latency. 5G networks and Wi-Fi 7 are rolling out. Advanced compression codecs like AV1 and H.266 VVC are cutting bandwidth requirements significantly. The technological foundation is coming together.

Smaller services are emerging too. Moonlight PC lets you stream games from your gaming PC to other devices—no subscription, just your existing hardware. AirGPU offers hourly rental of high-performance rigs, essentially cloud PCs without the upfront investment. These niche options are filling gaps the major platforms haven’t addressed.

Challenges remain, however. Internet stability is more critical than ever. Latency is improving but still problematic for competitive gaming. Bandwidth caps exist in many regions. Rural areas often lack the necessary infrastructure. Cloud gaming isn’t a universal solution, but for certain use cases—particularly mobile-first markets or casual players seeking flexibility—it’s becoming increasingly viable.

Hardware could shift as a result. If the heavy lifting happens in data centers, local devices might focus more on ergonomics, display quality, and connectivity rather than raw processing power.

VR and AR: Approaching Mainstream Adoption

VR has been “about to go mainstream” for over a decade. But the technology is finally catching up to the promise, making mass adoption increasingly plausible.

Current headsets like Meta Quest 3 offer wireless experiences with inside-out tracking. Apple Vision Pro blends AR and VR with advanced eye tracking and spatial computing. Sony’s PlayStation VR2 provides 4K HDR displays, haptic feedback, and exclusive game libraries. The hardware is becoming lighter, more comfortable, and less reliant on external sensors or cables.

Frame rates are pushing past 180Hz, reducing motion sickness—a persistent barrier to adoption. Eye tracking and foveated rendering are improving performance by rendering detail only where users are actually looking. These incremental improvements are creating measurably better experiences.

AI is playing a significant role. VR environments can adapt in real-time based on player actions. NPCs interpret voice commands and gameplay decisions dynamically. Motion tracking for hands, body movement, and eyes is being refined through AI algorithms.

AR adoption beyond Pokémon GO has been limited, but companies like Niantic, Apple, and Microsoft are investing heavily in AR glasses that blend digital overlays with the real world. The potential applications—strategy games on your dining table, location-based experiences, practical overlays for everyday tasks—exist in theory, though successful execution remains to be proven.

One emerging trend: the lines between console, PC, and VR platforms are blurring. Hardware manufacturers are building more flexible devices—hybrid controllers, modular components, universal accessories that work across formats.

AI Integration Across Gaming

AI 对游戏的影响涉及多个领域,成功程度各不相同。

Approximately one in three developers now use generative AI tools in their workflow. Applications range from procedural content generation—AI creating levels, landscapes, and challenges automatically—to art asset creation, dialogue generation, and QA testing where AI simulates player actions to identify bugs.

For NPCs, modern systems use large language models and reinforcement learning to create more dynamic behaviors. NPCs can adapt situationally, learn from player strategies, and engage in natural language dialogue. Some systems interpret player emotions and choices to create more responsive interactions.

Personalization is another application. AI monitors player activity and adjusts difficulty in real-time, creates unique story arcs based on choices, and provides tailored rewards matching player preferences. This enables games that adapt to individual skill levels and playstyles, though implementation quality varies significantly.

Graphics represent AI’s most visible impact. NVIDIA’s DLSS (Deep Learning Super Sampling) uses AI upscaling to make lower-resolution renders appear as native 4K without taxing hardware as heavily. DLSS 4 was announced at CES 2025. AMD’s competing FSR (FidelityFX Super Resolution) provides similar benefits. These technologies are becoming standard rather than premium features.

AI 驱动的光线追踪创造了逼真的光照、阴影和反射。性能提升显著——在不进行相应硬件升级的情况下提供更好的视觉效果。这对中端系统的玩家尤其重要。

Future developments include fully AI-generated worlds where environments, dialogues, and objectives are created dynamically, AI game assistants offering real-time hints tailored to individual players, and ultra-realistic NPCs that evolve over time based on interactions.

下一代主机硬件

微软和索尼似乎都在准备下一代硬件发布,可能最早在2026年底到2027年,尽管这些时间表可能会有所变化。

据报道,代号为“Magnus”的下一代 Xbox 可能采用 AMD Zen 6 CPU 架构和 AMD RDNA 5 GPU,约有 68 个计算单元——大致相当于 NVIDIA RTX 5080。目标性能是原生 4K 120fps,并改进光线追踪能力。它将使用 AMD FSR 进行升级,而不是像 PlayStation 的 PSSR 那样的专有 AI 升级。预计将完全向后兼容 Xbox Series X/S 库。

微软的策略可能比规格更重要。有报道称他们正在开发OEM主机-PC混合设备,最早可能在2026年推出,可能与华硕、联想或雷蛇等公司合作。这些设备将桥接主机和PC游戏,可能支持像Steam和Epic Games这样的PC商店的侧载。这代表了传统主机模式的重大转变。

PlayStation 6 的规格不太详细。预计规格包括 AMD Zen 6 核心和 AMD RDNA 5 GPU,约有 40-48 个计算单元。据报道,其设计理念与 PS4 方法类似——比 PS5 Pro 能力更强,但成本优化以实现大规模采用。据称 AMD 正在推动 Xbox 和 PlayStation 之间的共享架构,以实现规模经济。

索尼可能还在开发规格降低的手持版本,提供大约PS5一半的光栅化性能。PS6被定位为一款以游戏为中心的主机,拥有强大的第一方阵容,可能在2027年推出。

成本是一个重要的考虑因素。随着先进工艺节点(TSMC 3nm或2nm)、AI核心、更大的SSD和高端冷却,发布价格可能超过当前一代的定价。PS5 Pro以700美元推出;下一代主机可能根据配置在600到800美元以上。这一价格障碍可能会限制采用,尤其是在经济状况不确定的情况下。

GPU Technology: Competitive Landscape

尽管竞争加剧,NVIDIA 仍然是 GPU 市场的领导者。

NVIDIA 的 2028 年路线图雄心勃勃。2025 年的 Blackwell Ultra (B300 系列) 承诺性能提升 50%,配备高达 288GB 的 HBM4E 内存。2026 年的 Vera Rubin 架构,基于 TSMC 3nm 工艺,据 CEO 黄仁勋称,代表了显著的进步。到 2027 年,VR300 NVL576 系统可能提供当前 GB200 系统 21 倍的性能。计划在 2028 年推出 Feynman GPU。

这些主要是数据中心和AI专注的架构,但游戏GPU受益于技术下放。

AMD 的回应集中在 Instinct MI450 系列。2026 年推出,采用 TSMC 2nm 工艺的 CDNA 5 架构,将直接与 NVIDIA 的 Hopper、Blackwell 和 Rubin GPU 竞争。基于芯片的设计在内存容量和带宽方面为推理工作负载提供了优势。AMD 与 OpenAI 的合作涉及从 2026 年下半年开始部署 6 吉瓦的 MI450 GPU,可能在几年内产生超过 1000 亿美元的收入。

英特尔正在扩展到 AI GPU,2026 年下半年推出 Crescent Island GPU,采用 Xe3P 微架构,优化性能每瓦特,并配备 160GB LPDDR5X 内存用于推理工作流。它针对的是一个特定的利基市场——“代币即服务”提供商,而不是广泛竞争。

对于游戏,趋势包括AI驱动的超频以实现自动性能优化和实时适应的高级冷却系统。光线追踪正在成为一种基本期望,而不是一种高端功能。通过DLSS和FSR的AI升级能够实现更高的视觉保真度,而无需成比例的硬件成本——这可能是大多数玩家近期最有意义的改进。

PC Gaming Hardware: Steady Advancement

PC gaming hardware is advancing steadily across multiple fronts.

CPU 正在拥抱更多核心。2025 年的 AMD Ryzen 7 9800X3D 具有 8 个核心和 16 个线程,采用 Zen 5 架构和 3D V-cache,专为同时进行流媒体、录制和游戏的玩家优化。多任务处理能力是重点——处理苛刻的工作流程而不会造成瓶颈。

DDR5 RAM is becoming mainstream with faster speeds and lower prices. PCIe 5.0 SSDs are reducing load times significantly. HP OMEN systems now support up to 128GB DDR5-5600 RAM and 2TB PCIe Gen5 SSDs—specifications that were high-end recently are now standard in premium systems.

冷却技术正在进步。HP 的 OMEN Tempest Cooling 具有重新设计的风扇,增加了热管和风扇叶片,与前几代相比,气流增加了 1.49 倍。AI 驱动的优化检测游戏玩法并自动调整设置。内置风扇清洁消除了手动维护。这些是对持续性能至关重要的生活质量改进。

外设是竞技游戏直接影响硬件设计的领域。超响应鼠标的轮询率超过 8,000Hz,光学机械键盘结合速度与触感,针对电竞环境调校的空间音频耳机,以及刷新率超过 480Hz 的高刷新率显示器,代表了专业设置的前沿。这些技术中的许多最终会渗透到消费产品中。

Haptic feedback systems in controllers and peripherals are delivering richer tactile experiences. Wi-Fi 7 adoption is reducing latency in competitive scenarios. The advancement comes through incremental improvements across multiple areas rather than single breakthrough innovations.

An emerging trend: modular and customizable hardware that can be built, modified, and upgraded more easily. Swappable GPU docks, magnetic keyboard switches, user-upgradable VR headset modules, hot-swappable battery units in laptops, and 3D-printable case panels are becoming available. Some companies are exploring subscription-based modular upgrades—renting better GPU units or memory expansions. This concept addresses the rapid obsolescence problem that makes PC gaming expensive.

移动游戏的市场主导地位

移动游戏占全球 5220 亿美元游戏市场的 50% 以上——这是一个在主机或 PC 游戏讨论中容易被忽视的重要因素。

像苹果A17 Pro和高通Snapdragon G系列这样的移动芯片组正在使手机上实现光线追踪、网格着色和动态性能缩放。移动设备上的主机级图形不再是理想——在旗舰设备上已可实现。

Cross-platform progression where players seamlessly continue gameplay across mobile, console, and PC is increasingly standard. 5G optimization enables mobile games to leverage ultra-low latency for real-time multiplayer and AR experiences. The infrastructure is supporting increasingly demanding mobile gaming experiences.

移动游戏的人口统计与传统游戏市场不同,具有不同的期望、货币化模式和参与模式。行业正在适应收入所在的地方,这越来越意味着移动优先或移动包容性开发。

跨平台游戏作为标准

跨平台游戏已从可选功能转变为预期功能。像《堡垒之夜》、《使命召唤:战区》和《火箭联盟》这样的游戏将玩家连接在所有平台上。开发者受益于更广泛的受众和更长的游戏寿命。玩家受益于更大的玩家池,并可以与朋友一起游戏,无论平台如何。

Challenges remain in balancing gameplay between different control schemes—controller versus mouse and keyboard. Competitive integrity becomes complicated when input methods provide different advantages. Some games address this through matchmaking or input-based lobbies.

趋势很明显——平台独占的多人游戏正成为例外而非规则。发行商希望拥有最大的玩家基础,当所有人都在一起玩时,平台区别就不那么重要了。

Sustainability in Gaming Hardware

在某些市场中,环境责任正在从企业公关转向竞争考虑。主机和 PC 中的节能组件、可回收材料、环保包装、可持续制造实践以及云游戏的碳中和数据中心正在成为标准期望。

在环保意识市场中的消费者积极选择具有明显环境政策的品牌。这一群体足够显著,能够影响某些地区的市场份额,公司也在相应地做出回应。

Gaming’s carbon footprint is substantial—energy-intensive data centers, manufacturing processes, e-waste from hardware upgrades, and power consumption of gaming systems all contribute. Balancing innovation with sustainability commitments remains an ongoing challenge that the industry is beginning to address more seriously.

Future Developments: Likely Trends

Several trends appear likely to continue over the next few years:

Cloud gaming growth will continue, assuming infrastructure improvements persist. By 2030, for many gamers, internet connection may matter more than local hardware specifications. Devices could become more minimalist—focusing on ergonomics, display, and connectivity rather than internal processing power.

AI integration will become standard across hardware. Intelligent cooling systems, AI-enhanced resolution scaling, motherboards with onboard AI optimizing voltage and RAM allocation, and console AI profiles personalizing UI and adjusting difficulty will become commonplace.

VR/AR adoption may reach mainstream levels. 180Hz+ frame rates as standard, lighter wireless headsets, eye tracking and foveated rendering creating seamless experiences, and AR glasses potentially replacing headsets for casual use represent the trajectory. The technology is genuinely improved compared to previous generations.

Gaming hardware markets will evolve toward devices optimized for streaming rather than local processing, subscription-based upgrades instead of full system replacements, modular ecosystems allowing component-level upgrades, and sustainability-first design as consumer expectation. Whether these become dominant or remain niche depends on adoption rates.

Persistent Challenges

Latency in cloud gaming remains problematic for competitive play despite improvements. 5G/6G rollout, edge computing, AI-powered latency compensation, and regional data center expansion help, but physical limitations persist.

The digital divide continues to create barriers. Cloud gaming’s reliance on high-speed internet creates accessibility issues—bandwidth caps, rural and developing markets lacking infrastructure, and economic barriers to premium internet service all limit adoption. Technology doesn’t solve social and economic inequalities.

游戏中的 AI 伦理引发了对创意真实性、艺术家和设计师的工作流失、AI 训练系统中的偏见以及知识产权的担忧。行业正在推进 AI 集成,但这些伦理问题仍未解决。

尽管有可持续性努力,环境影响仍在继续。行业必须在创新与环境承诺之间取得平衡,而当前趋势严重偏向创新。

The Current State of Gaming Technology

Gaming technology in 2025-2026 is in transition—cloud infrastructure improving but not perfected, AI integration expanding but raising questions, VR/AR finally viable but not yet ubiquitous, and next-gen hardware approaching but expensive.

The global gaming market’s projected $522 billion valuation represents not just entertainment but a technology testbed. Innovations in AI, cloud computing, graphics processing, and immersive experiences often emerge in gaming first before spreading to other industries. This pattern appears likely to continue.

For gamers, developers, and hardware manufacturers, the next few years represent a continuation of existing trends reaching maturity. The boundaries between console, PC, mobile, and cloud gaming are blurring. Accessibility is improving. Performance continues advancing. Costs remain a barrier for cutting-edge experiences.

技术在进步——最重要的是它是否朝着改善游戏体验的方向发展,而不仅仅是提升规格。用户最终将通过他们对这些新技术的选择和参与来决定这一点。