Blockchain gaming gets a lot of hype, and the numbers behind it are actually compelling, even if the journey to get here has been anything but smooth.

We’re standing at what feels like a real inflection point. The sector has matured beyond the pure speculation phase, but it hasn’t quite hit the mainstream yet. Between the ambitious game studios, traditional publishers dipping their toes in, and millions of daily active players, something genuinely interesting is happening. It’s messy, volatile, and oddly fascinating. Let’s dig into where the space really stands.

The Numbers That Matter

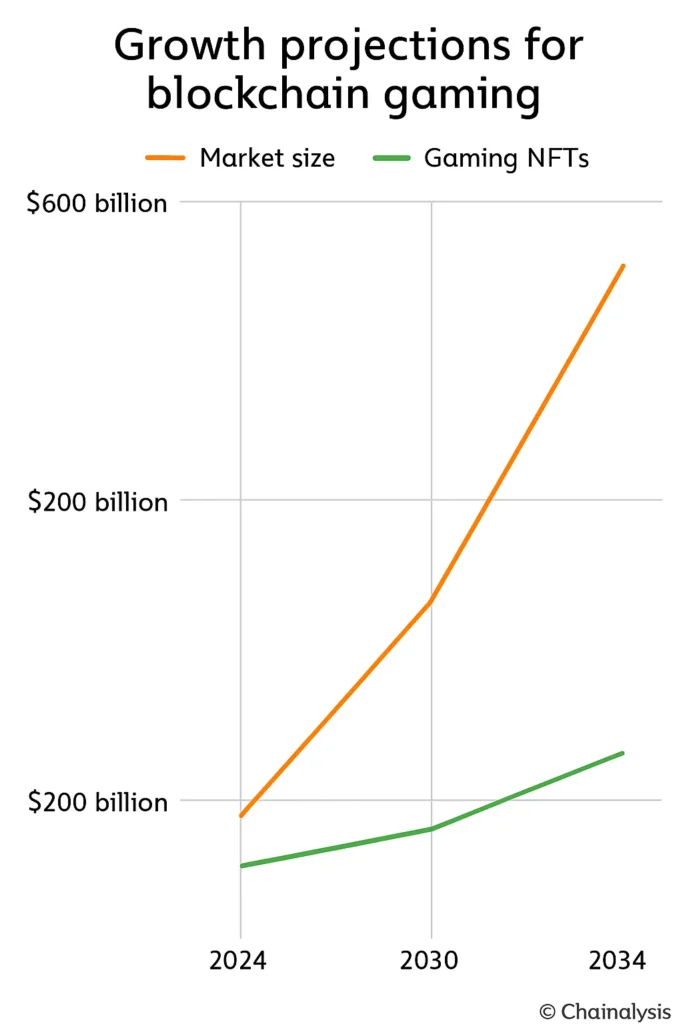

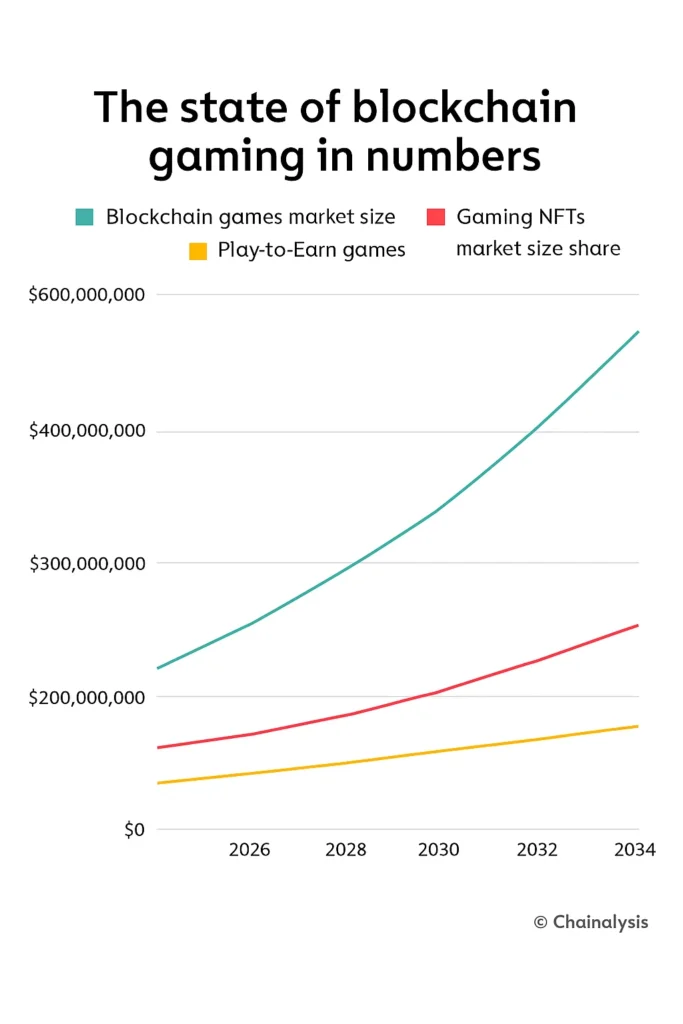

The market size estimates vary wildly depending on whom you ask, but even the conservative takes are eye-popping. One projection puts the 2024 market at around $13 billion, scaling to roughly $301 billion by 2030. That’s a 69% compound annual growth rate if things go according to plan. A more bullish model starts at $128 billion in 2024 and climbs to $614 billion by 2030.

Either way, we’re talking exponential growth here.

The sub-sectors tell similar stories. Gaming NFTs were worth about $4.8 billion in 2024 and could hit $44 billion by 2034. Play-to-earn games are smaller but growing just as fast: $1.35 billion last year, projected to reach $9 billion by 2033.

Here’s the context that matters: by 2022, gaming already accounted for nearly half of all blockchain transactions. This isn’t some fringe experiment anymore. It’s become foundational infrastructure.

Who’s Actually Playing?

The user adoption story is where things get interesting and slightly chaotic.

Daily active wallets hit 4.2 million by August 2024, which was solid month-over-month growth but a massive jump from 2023. By year-end, it climbed to 7.4 million. That’s more than a fourfold increase in just one year. Then 2025 arrived, and reality set in: April saw daily activity drop to around 4.8 million, a reminder that blockchain gaming follows the broader crypto market’s mood swings pretty closely.

On the transaction side, roughly 20 million gaming transactions happen on-chain daily. That adds up to nearly six billion transactions across 2024 alone. Weekly unique wallets averaged 2.8 million early in the year.

But here’s the uncomfortable truth: retention is fragile. About a third of new blockchain games lose players within 30 days. Nearly 30% of users disappear after just two weeks. The culprit? Usually dull gameplay or token systems that collapse under their economics.

Geography Matters (A Lot)

Asia-Pacific dominates, controlling roughly 26% of the 2024 market and nearly half of global user engagement. The Philippines alone accounts for 17% of daily players. For perspective, gaming there has become a genuine income source for millions of people.

North America sits near 24% of market share but generates around 40% of all Web3 gaming revenue. Studios like Mythical Games and Gala Games benefit from venture capital infrastructure and technical maturity. The U.S. has the funding and tools; Asia has the player base.

Europe’s taking a steadier approach, partly thanks to clear regulation. The EU’s MiCA framework finally gave developers and investors something concrete to build on. Germany, in particular, is becoming a reference market thanks to its emphasis on privacy and ownership rights.

The Money Flow Slowed (But Didn’t Stop)

Funding tightened dramatically in 2025. Total blockchain gaming investment dropped to roughly $293 million just a quarter of the previous year’s $1.8 billion. Ouch. But Q3 brought a mild rebound with $129 million raised, hinting at cautious optimism.

The standout rounds that still happened tell the story: E-PAL raised $30 million, Shrapnel brought in $19.5 million, and SuperGaming closed a $15 million round. Investors have clearly gotten pickier. Whitepapers and NFT hype don’t cut it anymore. Teams now need proof of traction and retention.

The interesting part? Crypto overall saw over $17 billion in new funding that year. Capital hasn’t disappeared it’s just moving toward quality. The days of funding anything with “blockchain” in the pitch deck are officially over.

Which Platforms Are Winning?

Ronin led the pack with about 1.3 million active wallets in August 2024, up almost a quarter in just one month. Originally built as an Axie Infinity sidechain, it’s now transitioning into a full Ethereum Layer 2 after some serious security incidents forced a rethink on architecture.

Ethereum still hosts roughly 38% of blockchain games despite its gas cost reputation. It remains the default for developers. BNB Chain supports around 30% of live games, while Polygon sits close behind with 17%, boosted by its 2025 AggLayer rollout that’s starting to link fragmented ecosystems.

Immutable X has a smaller market share (under 2%) but dominates NFT gaming, hosting over 600 titles. SKALE has carved out a nice niche too, hovering near 350,000 active wallets with steady growth.

The Games That Define the Space

RPGs still lead the genre breakdown, holding roughly 37% of market share in 2024. If projections hold, NFT-based RPGs could generate over $600 billion by 2030.

The flagship titles are largely recognizable names:

- Axie Infinity defined the category and still dominates, with 1.5 million daily players at its height and over $4 billion in total sales. It showed the world what Play-to-Earn could look like and also what happens when the token economy breaks.

- The Sandbox continues pushing the user-generated economy through land ownership and SAND tokens. It’s basically Roblox but decentralized.

- Gods Unchained operates as a trading card platform where you actually own your digital cards. No loot boxes, no licensing restrictions.

- Decentraland persists as a social and economic metaverse built on MANA. Love it or hate it, it’s been consistently active for years.

- Splinterlands maintains a loyal base through tournament mechanics and collectible strategy.

- Illuvium might be the first genuine AAA blockchain RPG, blending open-world exploration with collectible mechanics. It’s what serious studios are trying to build.

How Economics Actually Work

GameFi’s economy is programmable value in action. Here’s the breakdown:

- Utility tokens act like spendable currency. Axie’s SLP token, for example, is used to breed characters.

- Governance tokens give players voting rights on rule changes or how much new currency gets minted.

- NFTs represent actual ownership characters, land, items. Each is verifiable on-chain and tradable.

The tension in these systems is real. Some projects use deflationary mechanics with limited supply and scheduled burns to create scarcity. Others prefer inflation but offset it with buybacks or burn-on-trade functions. Token distribution usually includes vesting to prevent mass sell-offs and price crashes.

The balancing act is brutal: too much token emission and you get runaway inflation that kills the game’s economy. Too little, and engagement dries up because rewards feel meaningless.

Big Studios Are Finally Paying Attention

Traditional publishers aren’t sitting on the sidelines anymore.

Ubisoft launched its NFT platform Quartz. Square Enix went further, establishing a dedicated blockchain division in 2024 and confirming two NFT-based games for 2025. EA is exploring tokenized economies. Epic Games opened its store to Web3 titles. Both Sony and Sega are quietly experimenting in R&D.

Adoption remains slow, though. Wallet friction, regulatory uncertainty, and the stigma around “crypto games” keep major releases cautious. But the fact that these companies are moving at all? That’s significant.

The Obstacles That Actually Matter

Let’s talk about what’s holding the sector back, because the list is real.

Onboarding is brutal. More than half of developers in the 2024 Blockchain Game Alliance survey pointed to wallet setup and transaction friction as their main pain point. New players shouldn’t need a crypto education just to play a game.

- Scalability remains tight. Ethereum congestion drives developers toward Layer 2s like Polygon or Immutable X, but cross-network liquidity and integration are still tough problems.

- Token fatigue is real. The Play-to-Earn rush of 2021-22 revealed how unsustainable open-mint economies really are. Most projects that tried it crashed hard.

- Security scares linger. The $650 million Ronin bridge hack still haunts the industry. Trust rebuilds slowly.

- Regulation is all over the map. Studios are juggling compliance standards and tax questions that vary by country.

- Most games fail. Thousands of blockchain titles have been announced, but fewer than 10% attract more than 1,000 monthly users.

What’s Actually Changing

The industry conversation has shifted from “Play-to-Earn” to “Play-to-Own.” The focus is finally moving toward fun gameplay first, reward structure second. Revolutionary, right? But actually needed.

- Invisible wallets (custodial systems that handle seed phrases for you) are becoming the expected standard for 2025-26. If players don’t have to copy-paste seed phrases, adoption skyrockets.

- Cross-chain asset transfers are picking up pace. Networks like Oasys and Enjin are experimenting with shared inventories so your items work across multiple games. That’s genuinely cool.

- AI is entering the chat. Blockchain games are starting to use AI for personalized characters and worlds without bloating their token economy. Early experiments show real promise.

- Mobile dominance continues. Mobile accounts for just over half of all playtime in Web3 games. Millennials make up about 40% of the entire Web3 gamer base, and they’re playing on phones.

- DAOs are actual tools now. Projects like Decentraland are using decentralized governance so players genuinely vote on updates. It works better than it sounds.

Analysts expect metaverse-linked gaming to surpass $20 billion in transaction value by 2026. That’s not hype that’s infrastructure built to last.

Who Controls the Market

Roughly a dozen large studios command about 60% of total player volume. That concentration matters.

Animoca Brands remains a cornerstone, with holdings in The Sandbox and F1 Delta Time. Dapper Labs continues to monetize NFTs through NBA Top Shot. Mythical Games pushes infrastructure tools and SDKs, with FIFA Rivals coming soon. Gala Games focuses on player ownership models. Sky Mavis, the team behind Axie, is still central but working to diversify beyond a single hit.

The top studios are the ones solving real problems: infrastructure, onboarding, retention. That’s where the next wave of consolidation will happen.

What’s Next?

Despite recent funding dips, long-term sentiment is broadly optimistic. The global gaming market could reach $268 billion by 2025, while blockchain technology overall edges toward $67 billion by 2026. Blockchain gaming sits right where these two massive trends intersect.

Immutable’s leadership has argued repeatedly that the market remains “massively underestimated.” The infrastructure is there. The player base is there. The only question is whether studios can actually build games worth playing.

The Real Story

By 2025, blockchain gaming isn’t hype and isn’t maturity; it’s somewhere genuinely in between. Market projections show a twentyfold upside by the end of the decade. Daily users number in the millions. Traditional publishers are watching closely.

Sustained growth depends on execution. Studios must design games that are actually fun, streamline onboarding so new players don’t need a crypto degree, stabilize token economies, secure their smart contracts, and stay compliant with regulations.

Most importantly, they need to make sure blockchain actually improves something. Better ownership, more transparent economies, true player creativity. Not just blockchain for blockchain’s sake.

The future probably belongs to Play-to-Own models: limited emissions, real player governance, and assets that work across multiple games running smoothly on scalable infrastructure. If developers can make these systems feel invisible games first, crypto second the space could shift from speculative experiment to mainstream category.

For now, the industry stands resilient, still volatile, but undeniably evolving toward something larger than a passing cycle. The next two years will tell us whether it’s sustainable.